36+ Second home affordability calculator

Second mortgage affordability calculator. Here may come in handy our home affordability calculator that lets you assess your capacity of taking a loan.

How To Build A Real Estate Website In 2022 Step By Step Guide

With that magic number in mind you can.

. When it comes to calculating affordability your income debts and down payment are primary factors. This calculator helps you estimate how much home you can afford. Your housing expenses should be 29 or less.

How it Works. How much home can I afford. 15 20 30 year Should I pay discount points for a lower interest rate.

Simply enter your monthly income expenses and expected interest rate to get your estimate. This calculator is intended as a. Debt-to-Income Ratio DTI This is a percentage calculated based on the two definitions above your income and debts.

Factors that impact affordability. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Should I refinance my mortgage.

For example lets say your pre-tax monthly income is 5000. Adjust the loan terms to see. The proposed monthly mortgage payment of a home including taxes and insurance.

The home affordability calculator will also estimate your annual homeowners insurance costs and property tax percentage and your actual costs may be higher. Total income before taxes for you and your household members. How much house you can afford is also dependent on.

Find an estimate of how much mortgage or rent you can afford. It requires you to input data related to your income and current monthly debt. By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633.

Home affordability calculators use some basic information to determine your debt-to-income ratio. Your debt-to-income ratio DTI should be 36 or less. Use our online calculator to get a quick affordability assessment before submitting a full application with us.

You can afford a home worth up to 297163 with a total monthly payment of 1750. Your mortgage payment should be 28 or less. Comparing mortgage terms ie.

You can update these for a. You can find this by multiplying your income by 28 then dividing that by 100. Our second home mortgage calculator uses a maximum debt-to-income ratio of 43 overall which is the maximum amount that many lenders will accept.

In order to qualify for some types of loans you need below a certain. Provide details to calculate your affordability. Your maximum monthly mortgage payment would.

Payments you make for loans or other debt but not living expenses like.

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

2

Compare The Mortgage Affordability For Toronto We Compare The Avarage Price Of The Home Price Increasing And Mortgage Best Mortgage Lenders Real Estate Fun

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Mortgage Mortgage Payment

3386 St James Drive Se Southport Nc 28461 Trulia

How To Build A Real Estate Website In 2022 Step By Step Guide

Planning To Buy A House Spreadsheet Budgeting Worksheets Buying First Home Spreadsheet Business

How To Build A Real Estate Website In 2022 Step By Step Guide

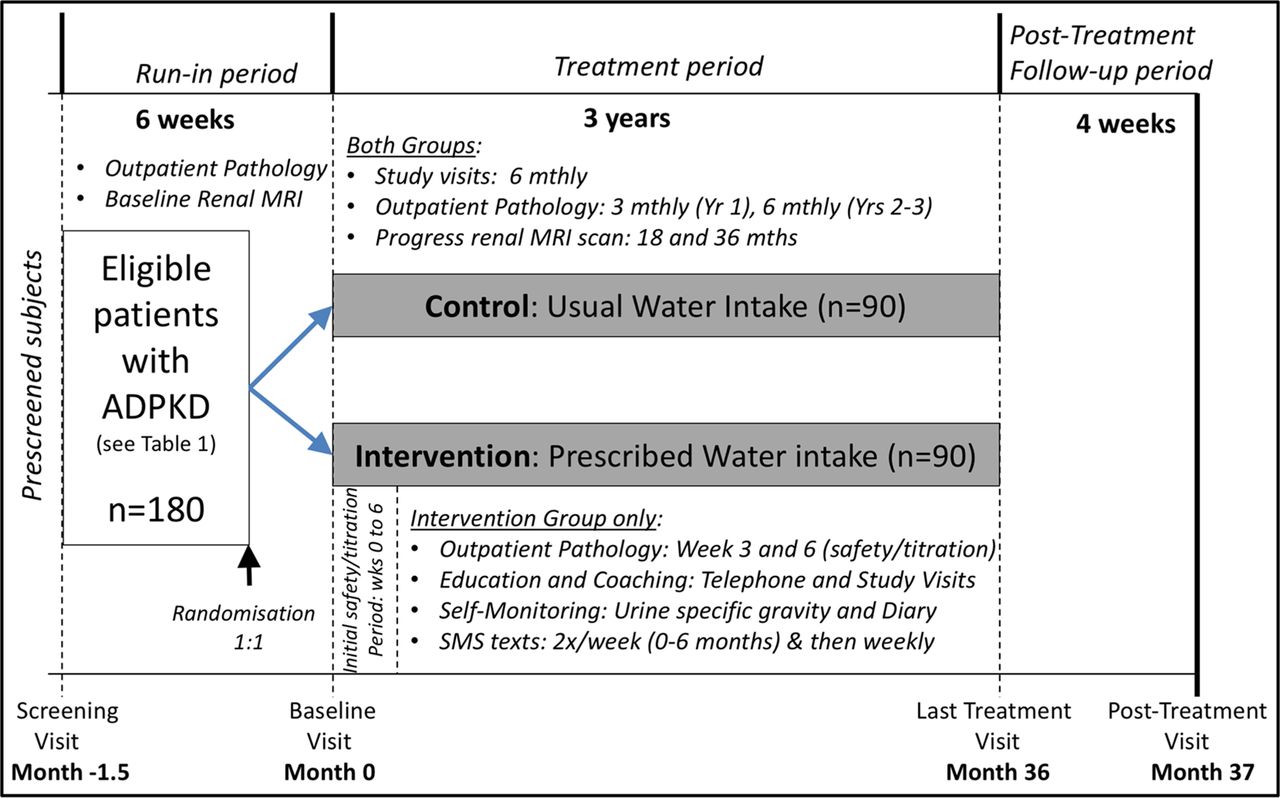

Randomised Controlled Trial To Determine The Efficacy And Safety Of Prescribed Water Intake To Prevent Kidney Failure Due To Autosomal Dominant Polycystic Kidney Disease Prevent Adpkd Bmj Open

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Refinance Loans

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Vyv27gyc Efsum

2

Finding The Right Home Could Be The Longest Or Shortest Part Of The Mortgage Process Timeline Mortgage Process Mortgage Mortgage Free

How Much Home Can I Afford Mortgage Affordability Calculator Updating House Mortgage Calculator Mortgage

U0ksai Ufwos9m

How To Build A Real Estate Website In 2022 Step By Step Guide